What is Neuroeconomics?

According to Wikipedia, neuroeconomics is an interdisciplinary field that combines neuroscience and economics to study human behavior as consumers or investors in certain economic decision-making situations using methods from neuroscience.

This means that this branch of science attempts to examine how the human brain works in economic decision-making situations to make better conclusions in a financial context.

The Brain and Financial Decisions

The brain is so incredibly fascinating and complex that modern science has only fully explored a small part of it to date.

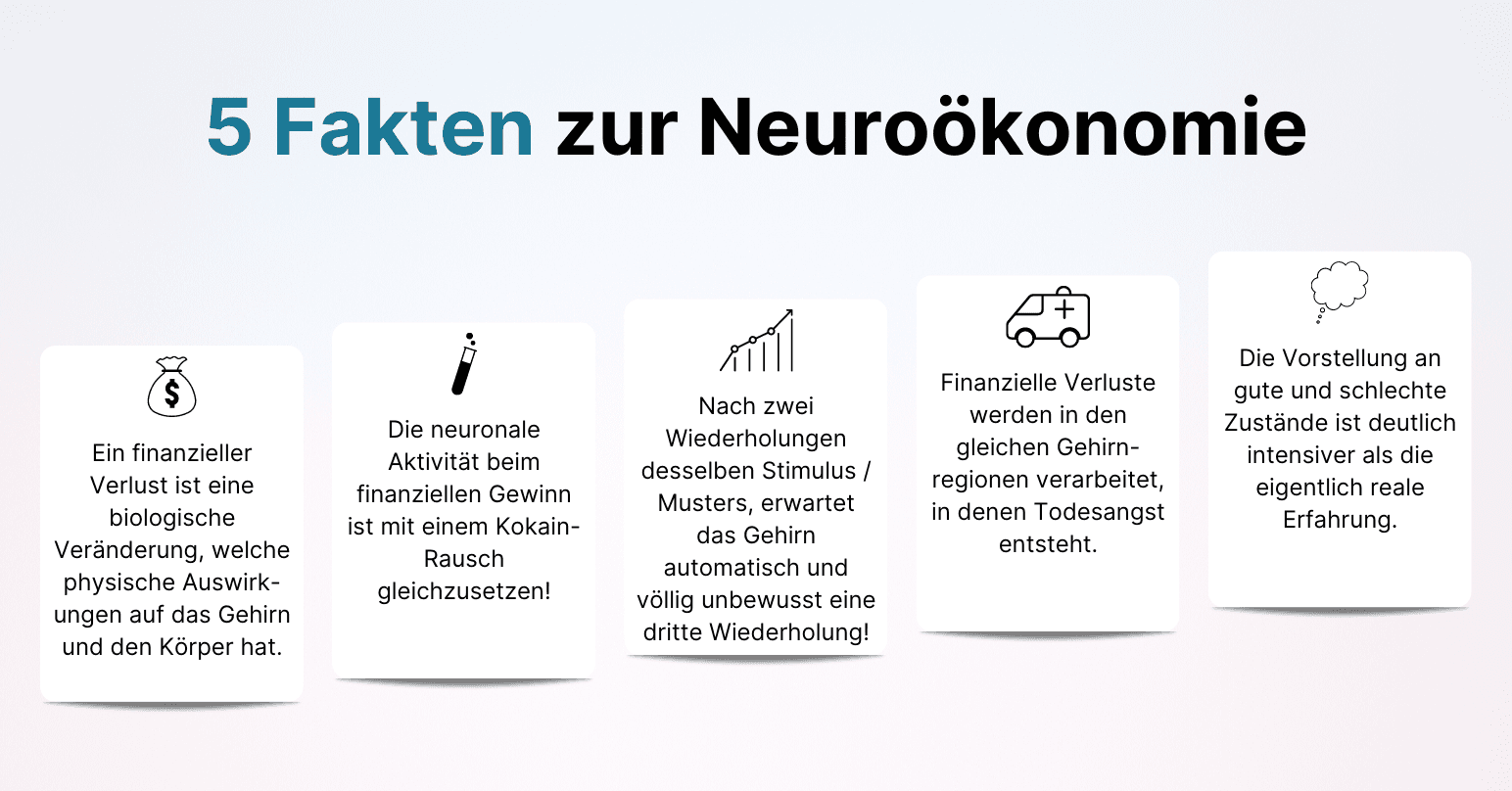

The following infographic shows how our brain works in financial decisions and why it often stands in the way of successful trading.

Financial Decisions and How Our Brain Reacts and Feels About Them

The five facts depicted in the figure accompany every person in financial decisions, and therefore also in trading. That's why it's important to be aware of them and to know how to deal with them. By the way, the origin of these facts often lies in the evolution of humans, where this behavior was important for the survival of humans, but nowadays, it rather gets in our way.

Reflexive and Reflective Information Processing

It may sound complicated at first, but it's not. Imagine it like this: Your brain works in two systems. One system works reflexively, known to us as intuitive. While I'm biking down the street, I don't want to think about how likely it is that I'll successfully reach my destination. I just do it and make decisions all the time reflexively.

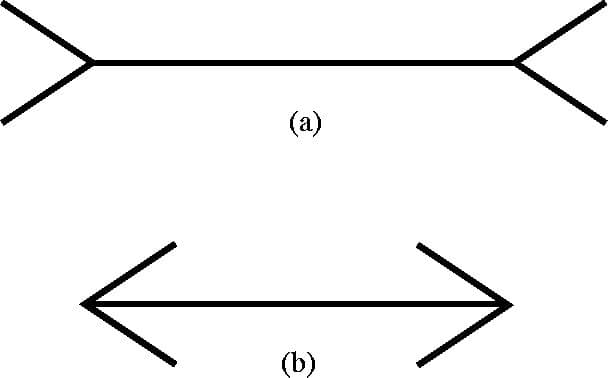

To make the difference between these two terms clear to you, here's an absolute classic. Take a look at the following illustration and decide: Which line is longer?

A classic example to explain the difference between reflexive and reflective perception

While you wanted to decide reflexively, your reflective system in this example notices that something is wrong. You reflect on your decision and the solution. What's exciting about this is that your reflexive system still thinks that (a) is longer, while your reflective system has clearly determined that both lines are identical!

If we transfer this problem to the stock market, we know why we make mistakes so often and act emotionally and intuitively so often. Intuition can work optimally if we have studied the underlying patterns for years. For all those who have not been active on the stock market for 10 years, this means: Never trust your intuition. That doesn't mean we shouldn't attach any value to it, but we have to reflect on why we think that way.

Put yourself in the following situation, which you have probably experienced yourself. You look at charts, see an intact uptrend and think that the stock price must continue to rise.

Why do you think that?

From now on, you should reflect on this spontaneous (reflexive) response. You do this by asking yourself another question: "Why are you right?" So, you have to objectively reflect on which chances speak for this thesis, how high the probabilities really are.

So, we can conclude: If we think in pictures (picture that the stock is rising quickly), then our reflexive system is currently active and we are completely disregarding the probabilities. If we formulate clear theses and reflect on the probabilities, we act correctly and independently of our emotions. The book Your Money and Your Brain: How the New Science of Neuroeconomics Can Help Make You Rich from Jason Zweig* offers an interesting insight into these phenomena.

Conclusion

As part of my personal trading, I check my decisions. Of course, despite years of experience, it happens that I take reflexive - and in these cases, bad trades. Nevertheless, I then reflect on my possible options. You see how complex the whole topic of successful trading is. Successful trading must be learned and is a process! But it is possible if we know which screws to turn, and we are aware of our deeply ingrained and evolutionary behaviors.

*This is either an advertisement or an affiliate link. If you click on this link and make a purchase or complete a transaction, we (depending on the provider) may receive a commission. You will not incur any additional costs and you will support our project. We thank you for your support!