Basically, trading is all about buying and selling. Nevertheless, there are countless different ways to ultimately buy or sell stocks and other trading instruments on the stock exchange. For this purpose, orders are used, with which a trader informs the broker how many units of a stock he wants to trade.

There are different types of orders to place this order. Essentially, these are the Limit Order and the Market Order.

What is the Market Order?

With the Market Order, the order to buy or sell stocks or other trading instruments is executed directly - at the price at which the stock is currently being traded. The goal of the Market Order is the quick and immediate execution of the order.

What is the Limit Order?

The Limit Order, on the other hand, is different. With the Limit Order, it is not about the fast, immediate execution of the order, but about executing the order at an explicit price. The Limit Order is only executed when the pre-defined price is reached.

This defined price can either be realized very soon or only in a few weeks. Therefore, the Limit Order is supplemented by a validity period that determines how long this order placed should remain valid in the future.

How does the Limit Order work?

Limit Orders allow buyers and sellers to set a price at which the trade will be executed. For buyers, the defined price of the Limit Order represents the maximum price at which they want to buy the stock. For sellers, on the other hand, the defined price of the Limit Order is the minimum at which they want to sell the stock.

This means that the buyer only wants to buy the stock when the stock reaches or falls below the price defined by him. The opposite applies to the seller. He only wants to sell his stocks when the defined limit price has been reached or is higher.

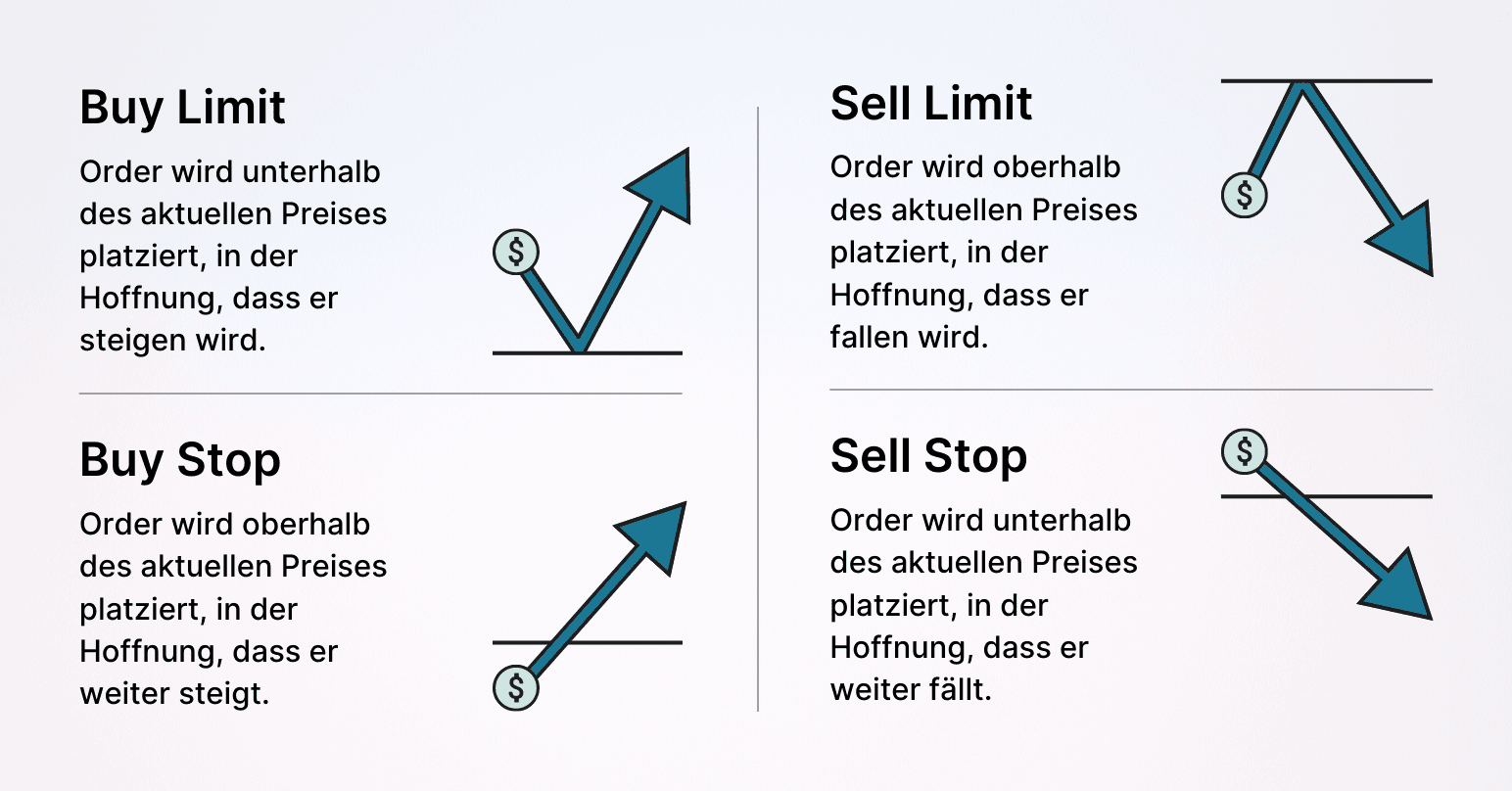

Basically, a distinction is made between the entry order (buying) and the exit order (selling). When entering with the Limit Order, the defined limit price must be lower than the current market price. Conversely, when exiting with the Limit Order, the limit price must be higher than the current market price. If this condition is not met and the Limit Order is still placed, it will be immediately placed on the market - similar to a Market Order.

Advantages of the Limit Order

- Thanks to the Limit Order, it is not necessary to continuously observe the market to enter the market at exactly the desired price.

- Through Limit Orders, it is possible to trade more targeted and cleaner. With the Limit Order, your order will be executed at the pre-defined price.

Disadvantages of the Limit Order

- It may be that the actual market price never reaches the defined limit price and your order is not executed.

- Depending on the validity of the Limit Order, it may be necessary to manually delete it to prevent unintended orders.

What is the Stop Order?

With a Stop Order, a stock can be bought or sold when a defined stop price is reached. At first glance, this sounds almost identical to the Limit Order. However, there is a crucial difference between these two order types: When a Stop Order is used to buy a stock, the price of the Stop Order is higher than the current market price (in contrast to the Limit Order, where the current market price must be lower). If the Stop Order is used to sell stocks, the defined price of the Stop Order is lower than the current price on the stock exchange (in contrast to the Limit Order, where the current market price must be higher). When the stop price is reached, the order is executed as a Market Order.

It may seem counterintuitive to buy after a stock price has risen and to sell after a stock price has fallen. So, why is this done?

Stop orders to buy a security are often placed when a trader believes that the stock will continue to rise after reaching the stop price. In this case, the trader believes that the stop price is the breakthrough of a stock.

A graphical comparison between the Limit Order and the Stop Order

When traders place a Stop Order to sell a stock, they are trying to protect their profits or limit their losses. If a stock falls to the stop price, the order is executed and the trader avoids further losses if the stock continues to fall. In that case, the Stop Order is called a Stop Loss Order.